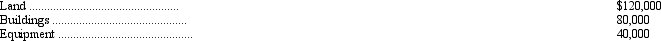

The Oscar Corporation acquired land, buildings, and equipment from a bankrupt company at a lump-sum price of $180,000. At the time of acquisition, Oscar paid $12,000 to have the assets appraised. The appraisal disclosed the following values:

What cost should be assigned to the land, buildings, and equipment, respectively?

A) $64,000, $64,000, and $64,000

B) $90,000, $60,000, and $30,000

C) $96,000, $64,000, and $32,000

D) $120,000, $80,000, and $40,000

Correct Answer:

Verified

Q9: If the cost of ordinary repairs is

Q17: Which of the following principles best describes

Q18: Lakepoint Company recently accepted a donation of

Q19: Which of the following intangible assets does

Q20: A company is constructing an asset for

Q22: An expenditure subsequent to acquisition of assembly-line

Q23: On June 30, 2011, Hi-Tech Inc. purchased

Q24: On July 31, 2011, Cleveland Company purchased

Q25: On October 1, Takei, Inc. exchanged 8,000

Q26: During 2011, Krieger, Inc. incurred the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents