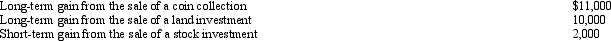

Kirby is in the 15% tax bracket and had the following capital asset transactions during 2013:  Kirby's tax consequences from these gains are as follows:

Kirby's tax consequences from these gains are as follows:

A) (5% ´ $10,000) + (15% ´ $13,000) .

B) (15% ´ $13,000) + (28% ´ $11,000) .

C) (0% ´ $10,000) + (15% ´ $13,000) .

D) (15% ´ $23,000) .

E) None of the above.

Correct Answer:

Verified

Q82: Hazel, a solvent individual but a recovering

Q84: During the year,Irv had the following transactions:

Q85: Denny was neither bankrupt nor insolvent but

Q87: Determine the proper tax year for gross

Q88: During 2013,Addison has the following gains and

Q90: On January 1,2013,Faye gave Todd,her son,a 36-month

Q90: Flora Company owed $95,000, a debt incurred

Q93: On January 1,2003,Cardinal Corporation issued 5% 25-year

Q104: During the year, Kim sold the following

Q108: Gull Corporation was undergoing reorganization under the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents