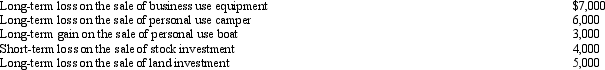

During the year,Irv had the following transactions:

How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Darryl,a cash basis taxpayer,gave 1,000 shares of

Q81: In January 2013,Tammy purchased a bond due

Q83: Roy is considering purchasing land for $10,000.He

Q85: Juan was considering purchasing an interest in

Q85: Denny was neither bankrupt nor insolvent but

Q87: Determine the proper tax year for gross

Q88: During 2013,Addison has the following gains and

Q89: Kirby is in the 15% tax bracket

Q108: Gull Corporation was undergoing reorganization under the

Q117: Our tax laws encourage taxpayers to _

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents