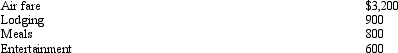

During the year,John went from Milwaukee to Alaska on business.Preceding a five-day business meeting,he spent four days vacationing at the beach.Excluding the vacation costs,his expenses for the trip are:  Presuming no reimbursement,deductible expenses are:

Presuming no reimbursement,deductible expenses are:

A) $3,200.

B) $3,900.

C) $4,800.

D) $5,500.

E) None of the above.

Correct Answer:

Verified

Q64: Under the actual cost method, which, if

Q65: Dave is the regional manager for a

Q66: Kristen's employer owns its building and provides

Q90: The § 222 deduction for tuition and

Q93: When using the automatic mileage method, which,

Q98: The § 222 deduction for tuition and

Q108: Corey is the city sales manager for

Q112: Due to a merger,Allison transfers from Miami

Q116: Amy works as an auditor for a

Q118: Louise works in a foreign branch of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents