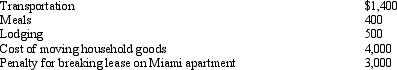

Due to a merger,Allison transfers from Miami to Chicago.Under a new job description,she is reclassified from employee to independent contractor status.Her moving expenses,which are not reimbursed,are as follows:  Allison's deductible moving expense is:

Allison's deductible moving expense is:

A) $0.

B) $5,900.

C) $6,100.

D) $8,900.

E) $9,300.

Correct Answer:

Verified

Q64: Under the actual cost method, which, if

Q65: Dave is the regional manager for a

Q66: Kristen's employer owns its building and provides

Q90: The § 222 deduction for tuition and

Q93: When using the automatic mileage method, which,

Q98: The § 222 deduction for tuition and

Q107: A U.S.citizen worked in a foreign country

Q108: Corey is the city sales manager for

Q113: During the year,John went from Milwaukee to

Q116: Amy works as an auditor for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents