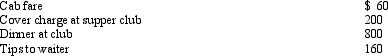

Robert entertains several of his key clients on January 1 of the current year.Expenses paid by Robert are as follows:  Presuming proper substantiation,Robert's deduction is:

Presuming proper substantiation,Robert's deduction is:

A) $610.

B) $640.

C) $740.

D) $1,220.

E) None of the above.

Correct Answer:

Verified

Q97: Which, if any, of the following is

Q100: Which of the following is not relevant

Q106: Frank established a Roth IRA at age

Q107: Mary establishes a Roth IRA at age

Q123: Juanita receives a $2,000 distribution from her

Q125: Sammy,age 31,is unmarried and is not an

Q126: In 2015,Kathy receives a $4,000 distribution from

Q129: Ralph made the following business gifts during

Q130: Priscella pursued a hobby of making bedspreads

Q132: Dana,age 31 and unmarried,is an active participant

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents