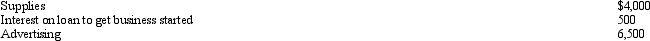

Priscella pursued a hobby of making bedspreads in her spare time.Her AGI before considering the hobby is $40,000.During the year she sold the bedspreads for $10,000.She incurred expenses as follows:  Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

A) Include $10,000 in income and deduct $11,000 for AGI.

B) Ignore both income and expenses since hobby losses are disallowed.

C) Include $10,000 in income,deduct nothing for AGI,and claim $11,000 of the expenses as itemized deductions.

D) Include $10,000 in income and deduct interest of $500 for AGI.

E) None of the above.

Correct Answer:

Verified

Q84: For an activity classified as a hobby,

Q89: One of the tax advantages of being

Q97: Which, if any, of the following is

Q100: Which of the following is not relevant

Q125: Sammy,age 31,is unmarried and is not an

Q126: In 2015,Kathy receives a $4,000 distribution from

Q127: Robert entertains several of his key clients

Q129: Ralph made the following business gifts during

Q132: Dana,age 31 and unmarried,is an active participant

Q134: Susan is a self-employed accountant with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents