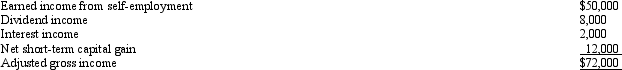

Susan is a self-employed accountant with a qualified defined contribution plan (a Keogh plan) .She has the following income items for the year:  What is the maximum amount Susan can deduct as a contribution to her retirement plan in 2013,assuming the self-employment tax rate is 15.3%?

What is the maximum amount Susan can deduct as a contribution to her retirement plan in 2013,assuming the self-employment tax rate is 15.3%?

A) $9,235.

B) $12,000.

C) $46,000.

D) $46,468.

E) None of the above.

Correct Answer:

Verified

Q84: For an activity classified as a hobby,

Q85: Which of the following correctly reflects current

Q89: One of the tax advantages of being

Q100: Which of the following is not relevant

Q113: Merrill is a participant in a SIMPLE

Q129: Ralph made the following business gifts during

Q130: Priscella pursued a hobby of making bedspreads

Q132: Dana,age 31 and unmarried,is an active participant

Q137: The ceiling amounts and percentages for 2013

Q138: Pat generated self-employment income in 2013 of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents