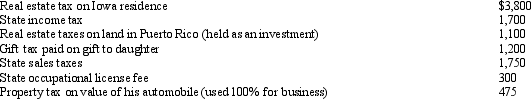

During 2013,Hugh,a self-employed individual,paid the following amounts:  What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

A) $6,600.

B) $6,650.

C) $7,850.

D) $8,625.

E) None of the above.

Correct Answer:

Verified

Q50: Edna had an accident while competing in

Q62: Rick and Carol Ryan, married taxpayers, took

Q81: Which of the following statements is true

Q83: Which of the following statements concerning the

Q93: The exclusion of interest on educational savings

Q139: Christie sued her former employer for a

Q142: Bob and Sally are married,file a joint

Q144: Karen,a calendar year taxpayer,made the following donations

Q146: Barry and Larry,who are brothers,are equal owners

Q147: Harry and Wilma are married and file

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents