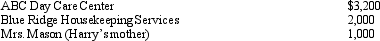

Harry and Wilma are married and file a joint income tax return.On their tax return,they report $44,000 of adjusted gross income ($20,000 salary earned by Harry and $24,000 salary earned by Wilma) and claim two exemptions for their dependent children.During the year,they pay the following amounts to care for their 16-year old son and 6-year old daughter while they work.  Harry and Wilma may claim a credit for child and dependent care expenses of:

Harry and Wilma may claim a credit for child and dependent care expenses of:

A) $840.

B) $1,040.

C) $1,200.

D) $1,240.

E) None of the above.

Correct Answer:

Verified

Q62: Rick and Carol Ryan, married taxpayers, took

Q63: Byron owned stock in Blossom Corporation that

Q81: Which of the following statements is true

Q142: Bob and Sally are married,file a joint

Q143: During 2013,Hugh,a self-employed individual,paid the following amounts:

Q144: Karen,a calendar year taxpayer,made the following donations

Q146: Barry and Larry,who are brothers,are equal owners

Q149: During 2013,Ralph made the following contributions to

Q150: Jermaine and Kesha are married,file a joint

Q151: Warren,age 17,is claimed as a dependent by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents