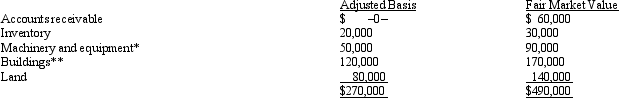

Kristine owns all of the stock of a C corporation which owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Q61: Trolette contributes property with an adjusted basis

Q63: Factors that should be considered in making

Q68: Robin Company has $100,000 of income before

Q73: Khalid contributes land (fair market value of

Q76: Which of the following is descriptive of

Q82: Swallow,Inc.,is going to make a distribution of

Q83: Kirby,the sole shareholder of Falcon,Inc.,leases a building

Q84: Doris is going to invest $90,000 in

Q85: Catfish,Inc.,a closely held corporation which is not

Q100: Which of the following statements is incorrect?

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents