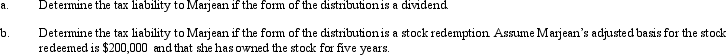

Swallow,Inc.,is going to make a distribution of $700,000 to Marjean who is in the 35% tax bracket.

Correct Answer:

Verified

Q61: Trolette contributes property with an adjusted basis

Q68: Robin Company has $100,000 of income before

Q73: Khalid contributes land (fair market value of

Q76: Which of the following is descriptive of

Q81: Kristine owns all of the stock of

Q83: Kirby,the sole shareholder of Falcon,Inc.,leases a building

Q84: Doris is going to invest $90,000 in

Q85: Catfish,Inc.,a closely held corporation which is not

Q87: Daisy,Inc.,has taxable income of $850,000 during 2013,its

Q100: Which of the following statements is incorrect?

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents