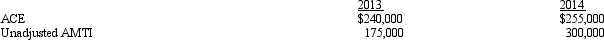

Duck,Inc.,is a C corporation that is not eligible for the small business exception to the AMT.Its adjusted current earnings (ACE)and unadjusted alternative minimum taxable income (unadjusted AMTI)for 2013 and 2014 are as follows:

Calculate the amount of the ACE adjustment for 2013 and 2014.

Calculate the amount of the ACE adjustment for 2013 and 2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: Candace, who is in the 33% tax

Q90: Eagle,Inc.recognizes that it may have an accumulated

Q90: Which of the following statements is correct?

A)

Q91: Devon owns 40% of the Agate Company

Q92: Kirk is establishing a business in 2013

Q94: Melba contributes land (basis of $190,000; fair

Q95: Bart contributes $100,000 to the Fish Partnership

Q96: Albert and Elva each own 50% of

Q97: Mr.and Ms.Smith's partnership owns the following assets:

Q99: Albert's sole proprietorship owns the following assets:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents