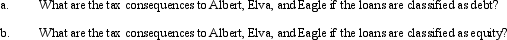

Albert and Elva each own 50% of the stock of Eagle,Inc.(a C corporation).To cover what is perceived as temporary working capital needs,each shareholder loans Eagle $200,000 with an annual interest rate of 6% (same as the Federal rate)and a maturity date of one year.The loan is made at the beginning of 2013.

Correct Answer:

Verified

Q89: Candace, who is in the 33% tax

Q90: Which of the following statements is correct?

A)

Q91: Devon owns 40% of the Agate Company

Q92: Kirk is establishing a business in 2013

Q94: Duck,Inc.,is a C corporation that is not

Q95: Bart contributes $100,000 to the Fish Partnership

Q97: Mr.and Ms.Smith's partnership owns the following assets:

Q99: Albert's sole proprietorship owns the following assets:

Q100: Blue,Inc.,has taxable income before salary payments to

Q101: Included among the factors that influence the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents