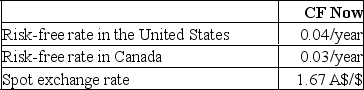

Consider the following:  If the futures market price is 1.63 A$/$, how could you arbitrage?

If the futures market price is 1.63 A$/$, how could you arbitrage?

A) Borrow Australian dollars in Canada convert them to dollars, lend the proceeds in the United States, and enter futures positions to purchase Canadian dollars at the current futures price.

B) Borrow U.S.dollars in the United States, convert them to Canadian dollars, lend the proceeds in Canada, and enter futures positions to sell Australian dollars at the current futures price.

C) Borrow U.S.dollars in the United States, invest them in the U.S., and enter futures positions to purchase Canadian dollars at the current futures price.

D) Borrow Canadian dollars in Canada and invest them there, then convert back to U.S.dollars at the spot price.

Correct Answer:

Verified

Q1: Consider the following: Q2: Which of the following is(are) example(s) of Q3: Foreign exchange futures markets are _, and Q4: Which one of the following stock index Q5: Which one of the following stock index Q6: Suppose that the risk-free rates in the Q7: Suppose that the risk-free rates in the Q8: Consider the following: Q9: Which one of the following stock index Q10: If a stock index futures contract is![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents