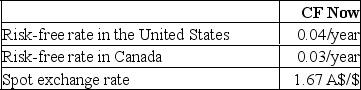

Consider the following:  Assume the current market futures price is 1.66 CAD$/$.You borrow 167,000 CAD$, convert the proceeds to U.S.dollars, and invest them in the U.S.at the risk-free rate.You simultaneously enter a contract to purchase 170,340 CAD$ at the current futures price (maturity of 1 year) .What would be your profit (loss) ?

Assume the current market futures price is 1.66 CAD$/$.You borrow 167,000 CAD$, convert the proceeds to U.S.dollars, and invest them in the U.S.at the risk-free rate.You simultaneously enter a contract to purchase 170,340 CAD$ at the current futures price (maturity of 1 year) .What would be your profit (loss) ?

A) Profit of 630 CAD$

B) Loss of 2300 CAD$

C) Profit of 2300 CAD$

D) Loss of 630 CAD$

Correct Answer:

Verified

Q2: Which of the following is(are) example(s) of

Q3: Foreign exchange futures markets are _, and

Q4: Which one of the following stock index

Q5: Which one of the following stock index

Q6: Consider the following: Q6: Suppose that the risk-free rates in the Q7: Suppose that the risk-free rates in the Q8: Consider the following: Q9: Which one of the following stock index Q10: If a stock index futures contract is![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents