Use the following information to answer the question(s) below.

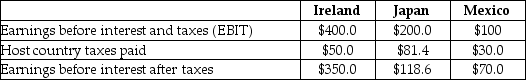

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the United States is currently 21%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Assuming that the Irish and Mexican subsidiaries did not exist,the U.S.tax liability on the Japanese subsidiary would be closest to:

A) $0.

B) $81 million.

C) $103 million.

D) $106 million.

Correct Answer:

Verified

Q35: Use the information for the question(s)below.

Luther Industries,a

Q36: Use the information for the question(s)below.

KT Enterprises,a

Q37: Luther Industries,a U.S.firm.has a subsidiary in the

Q38: Which of the following statements regarding the

Q39: How do the global intangible low tax

Q41: What conditions cause the cash flows of

Q42: Use the following information to answer the

Q43: Suppose the interest rate on Russian government

Q44: Which of the following statements is FALSE?

A)In

Q45: Which of the following statements is FALSE?

A)Many

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents