Use the following information to answer the question(s) below.

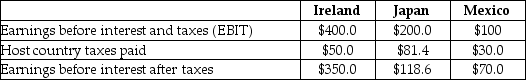

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the United States is currently 21%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Incorporated Tools' total U.S.tax liability on its foreign earnings is closest to:

A) $0.

B) $81 million.

C) $106 million.

D) $112 million.

Correct Answer:

Verified

Q37: Luther Industries,a U.S.firm.has a subsidiary in the

Q38: Which of the following statements regarding the

Q39: How do the global intangible low tax

Q40: Use the following information to answer the

Q41: What conditions cause the cash flows of

Q43: Suppose the interest rate on Russian government

Q44: Which of the following statements is FALSE?

A)In

Q45: Which of the following statements is FALSE?

A)Many

Q46: Which of the following statements is FALSE?

A)Differential

Q47: How do we make adjustments when a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents