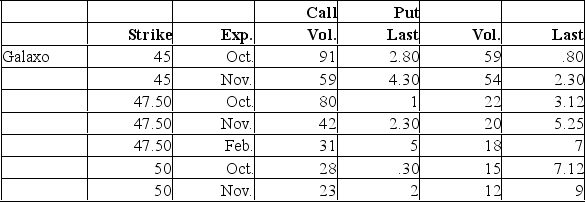

Underlying stock price: 45.80  Suppose you bought 10 Glaxo Oct 45 call contracts. Just before the option expires, the stock is selling for $50. What is your net profit (or loss) ? Ignore transaction costs.

Suppose you bought 10 Glaxo Oct 45 call contracts. Just before the option expires, the stock is selling for $50. What is your net profit (or loss) ? Ignore transaction costs.

A) -$220.

B) $1,200.00

C) $1,600.00

D) $2,200.00

E) $5,000.00

Correct Answer:

Verified

Q55: Three months ago,you purchased a put option

Q124: Neal owns a convertible bond that matures

Q125: A stock currently has a market value

Q126: A convertible bond has a face value

Q127: You own four call option contracts on

Q128: You sold one call option contract with

Q130: What is the value of a 6-month

Q131: You own a put option contract on

Q132: You own six call option contracts on

Q134: Kurt owns a convertible bond that matures

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents