Multiple Choice

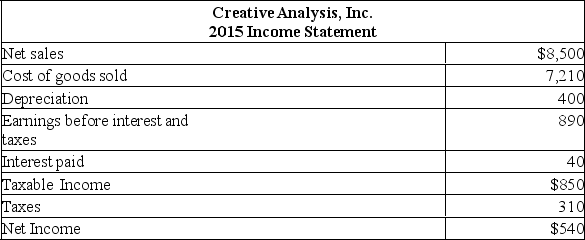

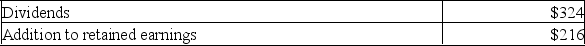

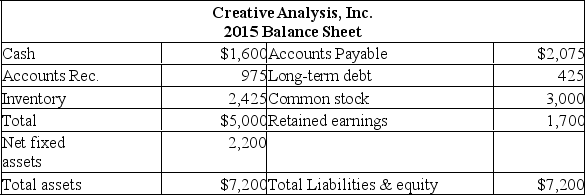

Creative Analysis, Inc. is currently operating at 70 percent of capacity. All costs and net working capital vary directly with sales. The tax rate, the profit margin, and the dividend payout ratio will remain constant. How much additional debt is required if no new equity is raised and sales are projected to increase by 10%?

Creative Analysis, Inc. is currently operating at 70 percent of capacity. All costs and net working capital vary directly with sales. The tax rate, the profit margin, and the dividend payout ratio will remain constant. How much additional debt is required if no new equity is raised and sales are projected to increase by 10%?

A) -$23.68

B) -$14.10

C) $3.80

D) $21.70

E) $54.90

Correct Answer:

Verified

Related Questions