Multiple Choice

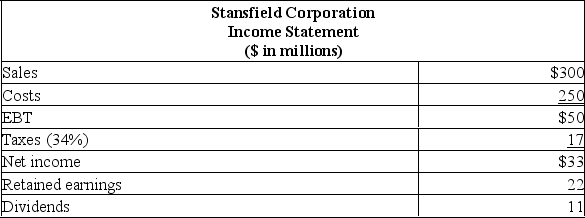

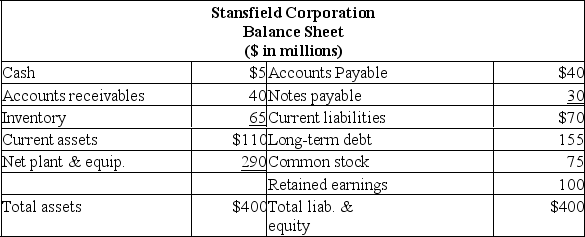

Assume Stansfield Corporation is utilizing its fixed assets at 90% capacity. Assume costs, current liabilities, and current assets vary directly with sales, and that the dividend payout ratio remains unchanged. If sales increase by 20%, what will total fixed assets be?

Assume Stansfield Corporation is utilizing its fixed assets at 90% capacity. Assume costs, current liabilities, and current assets vary directly with sales, and that the dividend payout ratio remains unchanged. If sales increase by 20%, what will total fixed assets be?

A) $256 million

B) $286 million

C) $313 million

D) $359 million

E) $470 million

Correct Answer:

Verified

Related Questions

Q108: A firm currently has sales of $550,000,

Q109: Q110: Q111: Q112: Q114: The following balance sheet and income statement Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

![]()