Multiple Choice

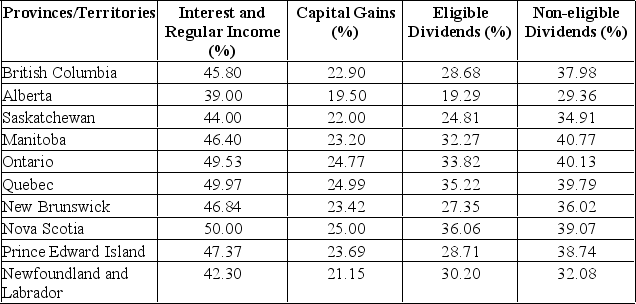

An Alberta resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid.

A) $13,105

B) $13,658

C) $14,105

D) $14,658

E) $15,105

Correct Answer:

Verified

Related Questions

Q44: Given the following statement of financial position

Q45: A Prince Edward Island resident earned

Q46: A New Brunswick resident earned $20,000

Q47: Q48: Q50: Q51: A $40,000 asset was purchased and classified Q52: BassiCorporation had a beginning and ending fixed Q53: A Quebec resident earned $20,000 in Q54: Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

![]()