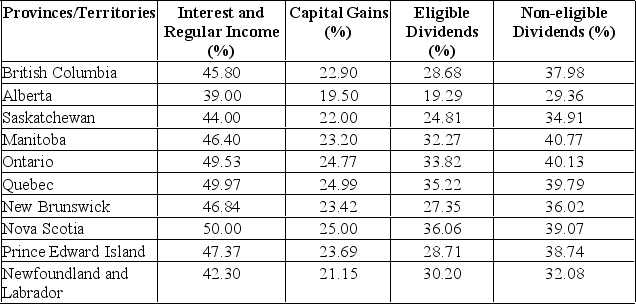

A Saskatchewan resident earned $40,000 in interest income and $60,000 in eligible dividends. Calculate the total tax paid.

A) $28,486

B) $29,486

C) $30,486

D) $31,486

E) $32,486

Correct Answer:

Verified

Q104: During 2018, Spend-it Corporation reported net income

Q105: A Manitoba resident earned $40,000 in

Q106: The Corner Store paid $46 in dividends

Q107: Q108: A British Columbia resident earned $40,000 Q110: Calculate ending fixed assets given the following Q111: Q112: A $40,000 asset was purchased and classified Q113: A $40,000 asset was purchased and classified Q114: Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()