Multiple Choice

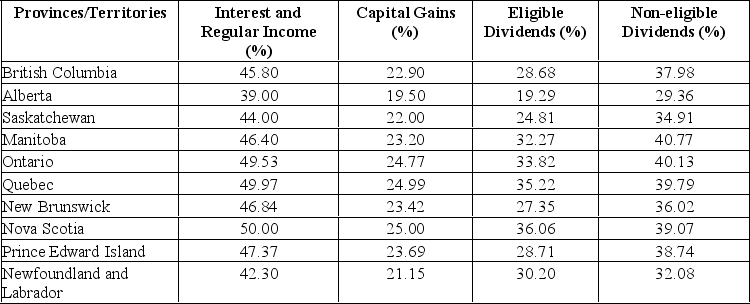

A British Columbia resident earned $40,000 in interest income and $60,000 in eligible dividends. Calculate the total tax paid.

A) $35,528

B) $36,531

C) $37,543

D) $38,559

E) $39,620

Correct Answer:

Verified

Related Questions

Q103: Q104: During 2018, Spend-it Corporation reported net income Q105: A Manitoba resident earned $40,000 in Q106: The Corner Store paid $46 in dividends Q107: Q109: A Saskatchewan resident earned $40,000 in Q110: Calculate ending fixed assets given the following Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()