Multiple Choice

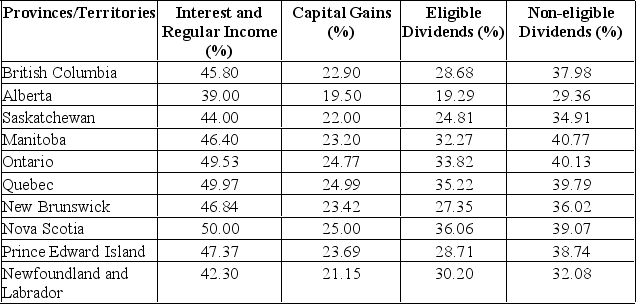

A Manitoba resident earned $40,000 in interest income and $60,000 in eligible dividends. Calculate the average tax rate.

A) 36.92%

B) 37.92%

C) 38.92%

D) 39.92%

E) 40.92%

Correct Answer:

Verified

Related Questions

Q200: An Alberta resident earned $40,000 in

Q201: Q202: Q203: A British Columbia resident earned $40,000 Q204: Q206: Q207: A Quebec resident earned $20,000 in Q208: An Ontario resident earned $40,000 in Q209: The repurchase of outstanding stock by a Q210: Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

![]()

![]()