Multiple Choice

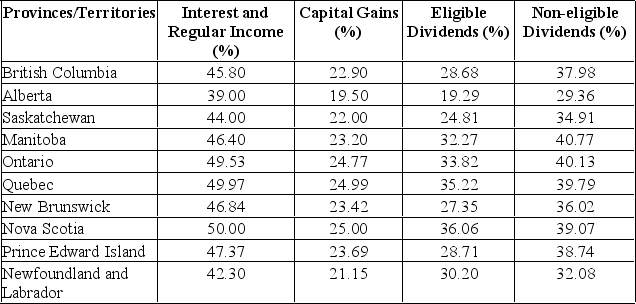

An Alberta resident earned $40,000 in interest income and $60,000 in eligible dividends. Calculate the average tax rate.

A) 29.13%

B) 28.98%

C) 27.17%

D) 26.90%

E) 26.20%

Correct Answer:

Verified

Related Questions

Q195: A British Columbia resident earned $30,000

Q196: If cash flow from operations is $938,

Q197: A Quebec resident earned $30,000 in

Q198: An Alberta resident earned $30,000 in

Q199: A Saskatchewan resident earned $30,000 in