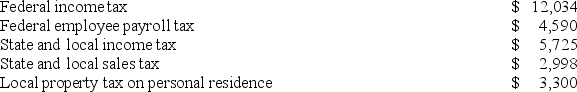

Spencer paid the following taxes this year.  Compute Spencer's itemized deduction for taxes.

Compute Spencer's itemized deduction for taxes.

A) $5,725

B) $13,615

C) $9,025

D) $10,000

Correct Answer:

Verified

Q44: Mr. Haugh owns a sporting goods store

Q45: Mr. and Mrs. Shohler received $25,200 Social

Q47: Which of the following expenditures is not

Q50: Which of the following tax payments is

Q50: Ms. Bjorn contributed $600,000 cash to qualified

Q51: Three years ago, Suzanne bought a new

Q55: Mr. and Mrs. McGraw received $50,160 Social

Q55: Which of the following government transfer payments

Q56: Mr.and Mrs.Oliva incurred the following unreimbursed medical

Q57: Which of the following donations doesn't qualify

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents