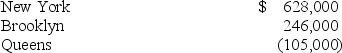

New York,Inc.owns 100% of Brooklyn,Inc.and Queens,Inc.Taxable income for the three corporations for their first year was as follows:  Which of the following statements is false?

Which of the following statements is false?

A) Consolidated taxable income is $769,000.

B) If a consolidated return is filed,Queens,Inc.will receive immediate tax benefit from its operating loss.

C) If Brooklyn,Inc.is a foreign corporation,it can be part of a consolidated return.

D) The corporations are not required to file a consolidated tax return if they are an affiliated group; however,they may elect to do so.

Correct Answer:

Verified

Q23: The Schedule M-3 reconciliation requires less detailed

Q38: Corporate taxable income earned before December 31,

Q44: A significant advantage of issuing stock instead

Q45: The double taxation of corporate earnings is

Q45: Corporations are rarely targeted in political debates

Q46: Thunder,Inc.has invested in the stock of several

Q49: Fleet, Inc. owns 85% of the stock

Q54: Loda Inc. made an $8,300 nondeductible charitable

Q59: The burden of corporate taxation is often

Q60: Frazier, Inc. paid a $150,000 cash dividend

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents