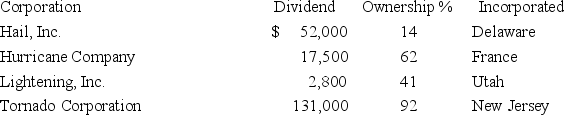

Thunder,Inc.has invested in the stock of several corporations and has $500,000 current year operating income before dividends:  Calculate Thunder's dividends-received deduction and taxable income:

Calculate Thunder's dividends-received deduction and taxable income:

A) DRD,$152,920; taxable income,$347,080.

B) DRD,$135,420; taxable income,$533,660.

C) DRD,$176,320; taxable income $526,980.

D) DRD $169,640; taxable income,$330,360.

Correct Answer:

Verified

Q43: Westside, Inc. owns 15% of Innsbrook's common

Q44: New York,Inc.owns 100% of Brooklyn,Inc.and Queens,Inc.Taxable income

Q44: A significant advantage of issuing stock instead

Q45: Corporations are rarely targeted in political debates

Q45: The double taxation of corporate earnings is

Q49: Fleet, Inc. owns 85% of the stock

Q51: In its first taxable year,Platform,Inc.generated a $100,000

Q54: Loda Inc. made an $8,300 nondeductible charitable

Q59: The burden of corporate taxation is often

Q60: Frazier, Inc. paid a $150,000 cash dividend

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents