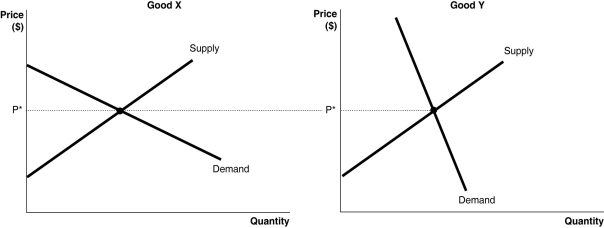

Figure 4-19

-Refer to Figure 4-19. The figure above illustrates the markets for two goods, Good X and Good Y. Suppose an identical dollar tax is imposed on sellers in each market.

a. Compare the consumer burden and producer burden in each market. Illustrate your answer graphically.

b. If the goal of the government is to raise revenue with minimum impact to quantity consumed, in which market should the tax be imposed?

c. If the goal of the government is to discourage consumption, in which market should the tax be imposed?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q175: The division of the burden of a

Q182: A tax is efficient if it imposes

Q185: An efficient tax is

A)a tax that imposes

Q186: Economists have shown that the burden of

Q186: What is "tax incidence"? What determines tax

Q190: The excess burden of a tax is

Q197: Article Summary

Voters in California approved a $2

Q199: If buyers were required to pay the

Q200: The division of the burden of a

Q365: Figure 4-20 ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents