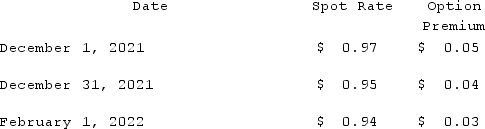

On December 1, 2021, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD) . Collection of the receivable is due on February 1, 2022. Keenan purchased a foreign currency put option with a strike price of $0.97 (U.S.) on December 1, 2021. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow:  Compute the fair value of the foreign currency option at December 1, 2021.

Compute the fair value of the foreign currency option at December 1, 2021.

A) $6,000.

B) $4,500.

C) $3,000.

D) $7,500.

E) $1,500.

Correct Answer:

Verified

Q19: Schrute Inc. had a receivable from a

Q20: Curtis purchased inventory on December 1, 2020.

Q21: On December 1, 2021, Keenan Company, a

Q22: On April 1, 2020, Shannon Company, a

Q23: A forward contract may be used for

Q25: All of the following data may be

Q26: On December 1, 2021, Keenan Company, a

Q27: U.S. GAAP provides guidance for hedges of

Q28: When a U.S. company purchases parts from

Q29: Which of the following statements is true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents