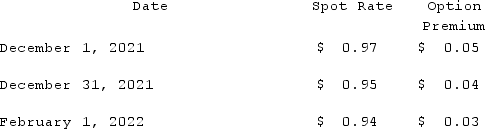

On December 1, 2021, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD) . Collection of the receivable is due on February 1, 2022. Keenan purchased a foreign currency put option with a strike price of $0.97 (U.S.) on December 1, 2021. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow:  Compute the U.S. dollars received on February 1, 2022.

Compute the U.S. dollars received on February 1, 2022.

A) $138,000.

B) $136,500.

C) $145,500.

D) $141,000

E) $142,500.

Correct Answer:

Verified

Q21: On December 1, 2021, Keenan Company, a

Q22: On April 1, 2020, Shannon Company, a

Q23: A forward contract may be used for

Q24: On December 1, 2021, Keenan Company, a

Q25: All of the following data may be

Q27: U.S. GAAP provides guidance for hedges of

Q28: When a U.S. company purchases parts from

Q29: Which of the following statements is true

Q30: On December 1, 2021, Keenan Company, a

Q31: A U.S. company buys merchandise from a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents