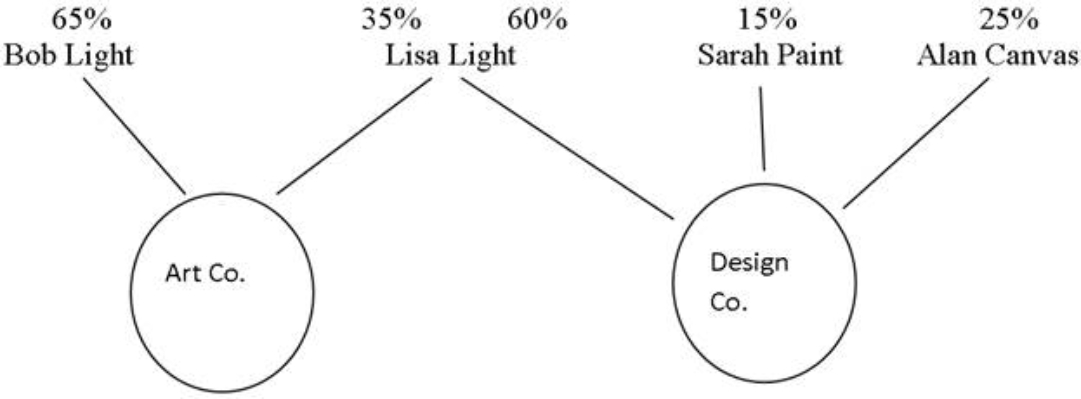

The following diagram depicts the ownership structure of two CCPCs. Bob Ligh is Lisa Light's son. Sarah Paint and Alan Canvas are not related to Bob and Lisa in any manner, what-so-ever. All of the shares held are common.

Required:

Required:

A) Determine if the two companies are associated, referring to the applicable section of the Income Tax Act.

B) Briefly explain what the most significant tax implication is when two or more corporations are associated.

Correct Answer:

Verified

Q2: There are several benefits to incorporating a

Q3: Corporation X had an RDTOH balance of

Q4: Which of the following types of corporate

Q5: Which of the following scenarios does not

Q6: Beans Co. is a Canadian-controlled private corporation

Q7: Private Co. received a $5,000 dividend from

Q8: Chartered Tours Inc. (CTI) started operations this

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents