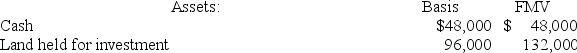

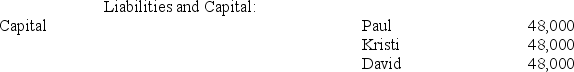

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000. Just prior to the sale, Paul's outside and inside bases in KDP are $48,000. KDP's balance sheet includes the following:

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

A) $0.

B) $36,000.

C) $12,000.

D) None of the choices are correct.

Correct Answer:

Verified

Q42: Which of the following statements is true

Q53: Which of the following statements is true

Q58: Jessica is a 25percent partner in the

Q59: Kristen and Harrison are equal partners in

Q61: Joan is a one-third partner in the

Q61: Daniela is a 25percent partner in the

Q63: Tyson is a 25percent partner in the

Q65: The PW Partnership's balance sheet includes the

Q65: Tyson is a 25percent partner in the

Q74: Kathy is a 25percent partner in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents