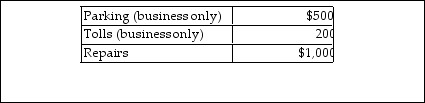

Chelsea, who is self- employed, drove her automobile a total of 20,000 business miles in 2018. This represents ab 75% of the auto's use. She has receipts as follows:  Chelsea uses the standard mileage rate method. She can deduct

Chelsea uses the standard mileage rate method. She can deduct

A) $12,600.

B) $10,900.

C) $11,600.

D) $11,425.

Correct Answer:

Verified

Q25: Clarissa is a very successful self-employed real

Q34: If the standard mileage rate is used

Q34: An employer adopts a per diem policy

Q35: Steven is a representative for a textbook

Q36: Joe is a self- employed tax attorney

Q37: A taxpayer goes out of town to

Q41: Ovi is a sales representative for a

Q48: In-home office expenses for an office used

Q52: Fin is a self-employed tutor,regularly meeting with

Q55: Educational expenses incurred by a self-employed CPA

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents