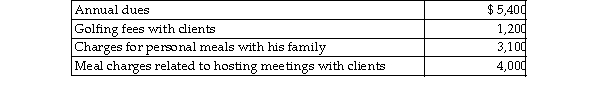

Joe is a self- employed tax attorney who frequently entertains his clients at his country club. Joe's club expenses i the following:  Assuming proper documentation is maintained, Joe may deduct

Assuming proper documentation is maintained, Joe may deduct

A) $5,300.

B) $4,000.

C) $2,000.

D) $2,600.

Correct Answer:

Verified

Q25: Clarissa is a very successful self-employed real

Q33: Commuting to and from a job location

Q33: Rui,the sole proprietor of a CPA firm,is

Q34: An employer adopts a per diem policy

Q34: If the standard mileage rate is used

Q35: Steven is a representative for a textbook

Q36: Generally,50% of the cost of business gifts

Q37: A taxpayer goes out of town to

Q39: Chelsea, who is self- employed, drove her

Q41: Ovi is a sales representative for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents