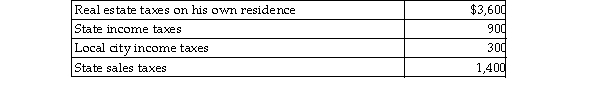

Matt paid the following taxes this year:  What is the maximum amount Matt can deduct as an itemized deduction on his tax return?

What is the maximum amount Matt can deduct as an itemized deduction on his tax return?

A) $5,000

B) $5,300

C) $4,800

D) $6,200

Correct Answer:

Verified

Q24: Self-employed individuals may deduct the full self-employment

Q53: Interest expense incurred in the taxpayer's trade

Q284: Discuss what circumstances must be met for

Q285: During the year Jason and Kristi, cash-

Q288: During the current year, Deborah Baronne, a

Q290: In February of the current year (assume

Q291: The following taxes are deductible as itemized

Q292: In 2018, Carlos filed his 2017 state

Q293: Arun paid the following taxes this year:

Q294: Hui pays self- employment tax on her

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents