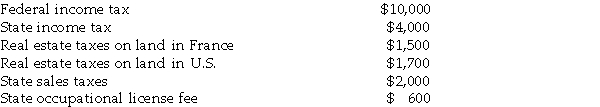

During the current year, Deborah Baronne, a single individual, paid the following amounts:  How much can Deborah deduct in taxes as itemized deductions?

How much can Deborah deduct in taxes as itemized deductions?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: Self-employed individuals may deduct the full self-employment

Q53: Interest expense incurred in the taxpayer's trade

Q283: On September 1, of the current year,

Q284: Discuss what circumstances must be met for

Q285: During the year Jason and Kristi, cash-

Q289: Matt paid the following taxes this year:

Q290: In February of the current year (assume

Q291: The following taxes are deductible as itemized

Q292: In 2018, Carlos filed his 2017 state

Q293: Arun paid the following taxes this year:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents