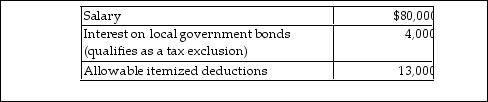

A single taxpayer provided the following information for 2018:  What is taxable income?

What is taxable income?

A) $71,000

B) $62,950

C) $67,000

D) $80,000

Correct Answer:

Verified

Q2: The standard deduction may not be claimed

Q13: Nonresident aliens are allowed a full standard

Q20: For purposes of the dependency exemption,a qualifying

Q22: One requirement for claiming a dependent as

Q27: Parents must provide more than half the

Q32: A daughter or son may not satisfy

Q40: For purposes of the dependency criteria,a qualifying

Q929: Hannah is single with no dependents and

Q936: The following information is available for Bob

Q937: All of the following items are included

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents