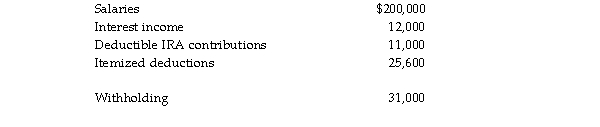

The following information is available for Bob and Brenda Horton, a married couple filing a joint return, for 2018 Bob and Brenda are age 32 and have no dependents.  a. What is the amount of their gross income?

a. What is the amount of their gross income?

b. What is the amount of their adjusted gross income?

c. What is the amount of their taxable income?

d. What is the amount of their tax liability (gross tax), rounded to the nearest dollar?

e. What is the amount of their tax due or (refund due)?

Correct Answer:

Verified

Q12: Nonrefundable tax credits are allowed to reduce

Q13: Nonresident aliens are allowed a full standard

Q20: For purposes of the dependency exemption,a qualifying

Q22: One requirement for claiming a dependent as

Q27: Parents must provide more than half the

Q32: A daughter or son may not satisfy

Q40: For purposes of the dependency criteria,a qualifying

Q934: A single taxpayer provided the following information

Q937: All of the following items are included

Q941: Ben, age 67, and Karla, age 58,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents