Sandy and Larry each have a 50% interest in SL Partnership. The partnership and the individuals file on a calendar- year basis. In 2017, SL Partnership had a $30,000 ordinary loss. Sandy's adjusted basis in her partnership interest on January 1, 2017, was $12,000. In 2018, SL Partnership had ordinary income of $20,000. Assuming there were no other adjustments to Sandy's basis in the partnership, what amount of partnership income (loss) would Sandy show on her 2017 and 2018 individual income tax returns?

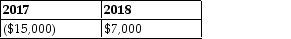

A)

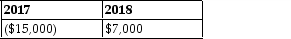

B)

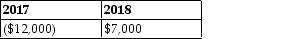

C)

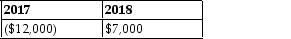

D)

Correct Answer:

Verified

Q87: Joy is a material participant in a

Q1177: Martha transferred property with a FMV of

Q1178: Patrick acquired a 50% interest in a

Q1179: On April 5, 2018, Joan contributes business

Q1180: Ezinne transfers land with an adjusted basis

Q1181: A taxpayer has various businesses which operate

Q1183: Richard has a 50% interest in a

Q1185: David and Joycelyn form an equal partnership

Q1186: Jamahl has a 65% interest in a

Q1187: Clark and Lois formed an equal partnership

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents