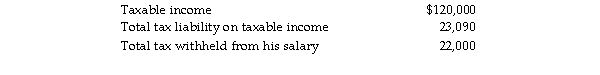

Frederick failed to file his 2018 tax return on a timely basis. In fact, he filed his 2018 income tax return on Octobe 2019, (the due date was April 17, 2019) and paid the amount due at that time. He failed to make timely extension are amounts from his 2018 return:  Frederick sent a check for $1,090 in payment of his liability. He thinks that he has met all of his financial obligations to the government for 2018. For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,090 in payment of his liability. He thinks that he has met all of his financial obligations to the government for 2018. For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2225: Latashia reports $100,000 of gross income on

Q2226: Describe the components of tax practice.

Q2227: Explain how returns are selected for audit.

Q2228: Alan files his 2017 tax return on

Q2229: The computer is the primary tool of

Q2230: Describe the types of audits that the

Q2231: Kate files her tax return 36 days

Q2232: Peyton has adjusted gross income of $2,000,000

Q2233: The IRS must pay interest on

A) tax

Q2234: Which of the following individuals is most

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents