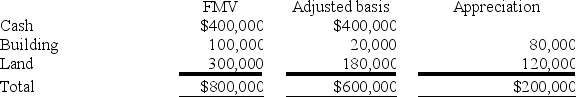

Oriole,Inc.decided to liquidate its wholly-owned subsidiary,Tiger Corporation.Tiger had the following tax accounting balance sheet.

a.What amount of gain or loss does Tiger recognize in the complete liquidation?

a.What amount of gain or loss does Tiger recognize in the complete liquidation?

b.What amount of gain or loss does Oriole recognize in the complete liquidation?

c.What is Oriole's tax basis in the building and land after the complete liquidation?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Ken and Jim agree to go into

Q91: Gary and Laura decided to liquidate their

Q92: Gary and Laura decided to liquidate their

Q94: Mike and Michelle decided to liquidate their

Q95: Mike and Michelle decided to liquidate their

Q96: Harry and Sally formed Empire Corporation on

Q97: Don and Marie formed Paper Lilies Corporation

Q98: Gary and Laura decided to liquidate their

Q116: Jasmine transferred 100 percent of her stock

Q120: The City of Boston made a capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents