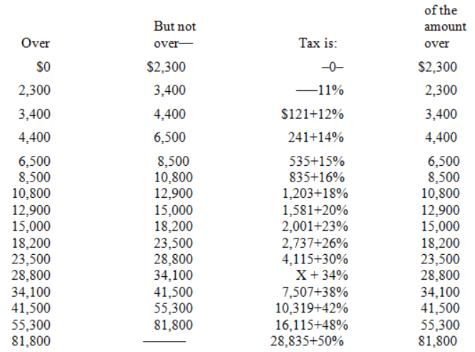

USE THE FOLLOWING TAX RATE SCHEDULE TO ANSWER THE NEXT SIX QUESTIONS.

If taxable income is:

-Mr. Smith has adjusted gross income of $26,000 and taxable income of $15,200. What is Mr. Smith's marginal tax rate to the nearest tenth of a percent) ?

A) 7.9%

B) 13.5%

C) 23.0%

D) 30.0%

Correct Answer:

Verified

Q11: USE THE FOLLOWING TAX RATE SCHEDULE TO

Q12: USE THIS INFORMATION FOR THE NEXT THREE

Q13: THESE FACTS ARE USED FOR THE NEXT

Q14: THESE FACTS ARE USED FOR THE NEXT

Q15: A state's basic individual income tax applies

Q17: USE THIS INFORMATION FOR THE NEXT THREE

Q18: USE THIS INFORMATION FOR THE NEXT THREE

Q19: Under the current federal individual income tax

Q20: Tax credits, exemption, and exclusions all can

Q21: The present federal income tax structure would:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents