USE THIS INFORMATION FOR THE NEXT THREE QUESTIONS.

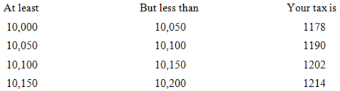

A federal tax table contains the following excerpt:

If taxable income is:

-A person has adjusted gross income of 15,000 and taxable of 10,125. In what marginal rate bracket is that person?

A) 10%

B) 12%

C) 24%

D) 28%

Correct Answer:

Verified

Q7: THESE FACTS ARE USED FOR THE NEXT

Q8: USE THE FOLLOWING TAX RATE SCHEDULE TO

Q9: Which of the following is not an

Q10: Which of the following is true?

A) Taxable

Q11: USE THE FOLLOWING TAX RATE SCHEDULE TO

Q13: THESE FACTS ARE USED FOR THE NEXT

Q14: THESE FACTS ARE USED FOR THE NEXT

Q15: A state's basic individual income tax applies

Q16: USE THE FOLLOWING TAX RATE SCHEDULE TO

Q17: USE THIS INFORMATION FOR THE NEXT THREE

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents