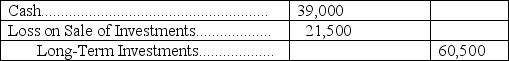

On January 4, 2011, Larsen Company purchased 5,000 shares of Warner Company for $59,500 plus a broker's fee of $1,000. Warner Company has a total of 25,000 shares of common stock outstanding and it is presumed the Larsen Company will have a significant influence over Warner. During each of the next two years, Warner declared and paid cash dividends of $0.85 per share. Its net income was $72,000 and $67,000 for 2011 and 2012, respectively. The January 12, 2013, entry to record the sale of 3,000 shares of Warner Company stock for $39,000 cash should be:

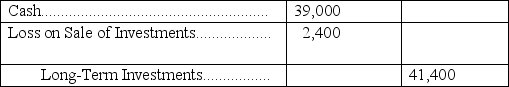

A)

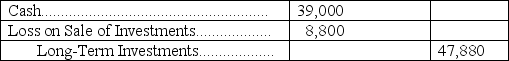

B)

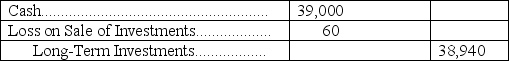

C)

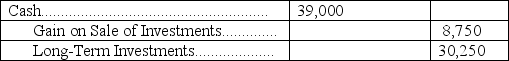

D)

E)

Correct Answer:

Verified

Q87: Micron owns 35% of Martok. Martok pays

Q104: On January 1, 2011, Posten Company purchased

Q104: On June 18,Johnson Company (a U.S.company) sold

Q105: On November 12, Kera, Inc., a U.S.

Q107: A U.S. company makes a sale to

Q108: Vans purchased 40,000 shares of Skechers common

Q110: On November 12, Kendra, Inc., a U.S.

Q111: If a company owns more than 20%

Q112: A company had investments in long-term available-for-sale

Q159: What are the accounting basics for debt

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents