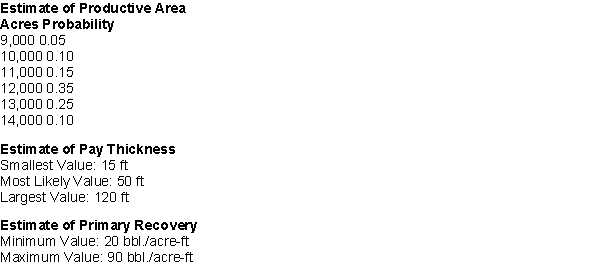

An oil company is trying to determine the amount of oil that it can expect to recover from an oil field. The unknowns are: the area of the field (in acres), the thickness of the oil-sand layer, and the primary recovery factor (in barrels per acre per foot of thickness). Based on geological information, the following probability distributions have been estimated  The amount of reserves that can be produced is then the product of the area, thickness, and recovery factor:

The amount of reserves that can be produced is then the product of the area, thickness, and recovery factor:

Number of barrels = Productive Area x Pay Thickness x Primary Recovery Factor

-(A) Use @RISK distributions to generate the three random variables and derive a distribution for the amount of reserves. What is the amount we can expect to recover from this field?

(B) The production output is a product of three very different types of input distributions. What does the output distribution look like? What are the implications of the shape of this distribution?

(C) What is the standard deviation of the recoverable reserves? What are the 5th and 95th percentiles of this distribution? What does this imply about the uncertainty in estimating the amount of recoverable reserves?

(D) Suppose you think oil price is normally distributed with a mean of $65 per barrel and a standard deviation of $10. How much revenue do you expect the field to produce (ignore discounting)?

(E) Finally, your engineer is uncertain about costs to drill wells to develop the field, but she thinks the most likely cost will be $1.7Bn, although it could be as much as $3Bn or as little as $1Bn. What is your expected profit from the field?

(F) What is the chance that you will loose money? Is this a risky venture?

Correct Answer:

Verified

(A) The output snapshot below shows me...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: A correlation matrix must always have 1's

Q30: Data tables in spreadsheet simulations are useful

Q31: A common guideline in constructing confidence intervals

Q36: Different random numbers generated by the computer

Q39: Correlation between two random input variables might

Q55: Many companies have used simulation to determine

Q77: (A) What are the appropriate probability distributions

Q78: Suppose you run a simulation model several

Q80: Suppose you are going to invest equal

Q81: (A) Use a simulation model to help

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents