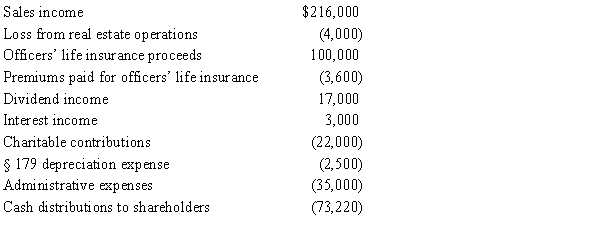

Towne, Inc., a calendar year S corporation, holds AAA of $627,050 at the beginning of 2015. During the year, the following items occur.

Calculate Towne's ending AAA balance.

Correct Answer:

Verified

Q104: Which tax provision does not apply to

Q106: A termination occurs on the day that

Q110: When an S corporation liquidates, which of

Q113: Discuss two ways that an S election

Q117: Advise your client how income, expenses, gain,

Q124: Alomar, a cash basis S corporation in

Q126: Distribution of loss property by an S

Q128: Estela, Inc., a calendar year S corporation,

Q138: With respect to passive losses,there are three

Q155: Chris,the sole shareholder of Taylor,Inc. ,elects during

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents