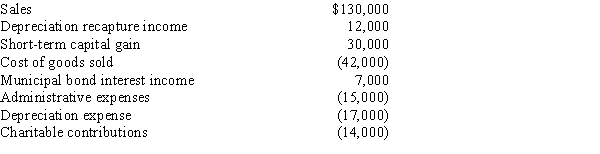

Bidden, Inc., a calendar year S corporation, incurred the following items.

Calculate Bidden's nonseparately computed income.

Correct Answer:

Verified

Q103: Stock basis first is increased by income

Q113: Discuss two ways that an S election

Q121: Explain the OAA concept.

Q126: Distribution of loss property by an S

Q128: Estela, Inc., a calendar year S corporation,

Q129: You are a 60% owner of an

Q130: Gene Grams is a 45% owner of

Q132: Depletion in excess of basis in property

Q136: If an S corporation shareholder's basis in

Q138: With respect to passive losses,there are three

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents