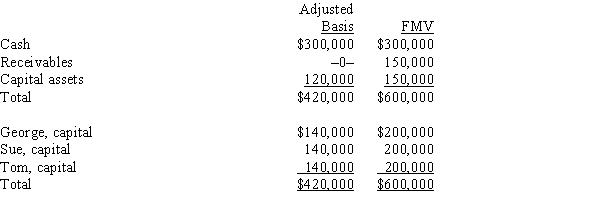

The December 31, 2014, balance sheet of GST Services, LLP reads as follows:  The partners share equally in partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership, and all partners are active in the business. On December 31, 2014, general partner Sue receives a distribution of $200,000 cash in liquidation of her partnership interest under § 736. Sue's outside basis for the partnership interest immediately before the distribution is $150,000. (Her basis does not correspond to her capital account because she purchased the interest a few years ago at a $10,000 premium.) How much is Sue's gain or loss on the distribution and what is its character?

The partners share equally in partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership, and all partners are active in the business. On December 31, 2014, general partner Sue receives a distribution of $200,000 cash in liquidation of her partnership interest under § 736. Sue's outside basis for the partnership interest immediately before the distribution is $150,000. (Her basis does not correspond to her capital account because she purchased the interest a few years ago at a $10,000 premium.) How much is Sue's gain or loss on the distribution and what is its character?

A) $50,000 ordinary income.

B) $40,000 ordinary income; $10,000 capital gain.

C) $40,000 capital gain; $10,000 ordinary income.

D) $50,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Q72: Brittany, Jennifer, and Daniel are equal partners

Q75: Which of the following is not typically

Q75: The December 31, 2014, balance sheet of

Q76: Which of the following distributions would never

Q78: Cynthia sells her 1/3 interest in the

Q80: Which of the following statements about the

Q114: Match the following statements with the best

Q132: Nicholas is a 25% owner in the

Q135: Which of the following statements is true

Q174: Match each of the following statements with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents